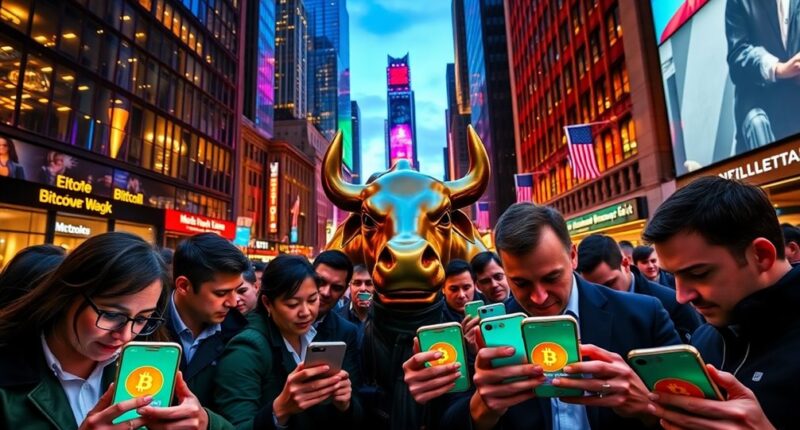

You might have noticed how Wall Street's perception of Bitcoin is shifting. Once viewed with skepticism, it's now gaining traction as a credible asset class. Major financial institutions are stepping in, and the recent approval of spot Bitcoin ETFs marks a significant turning point. As Bitcoin aligns more closely with traditional markets, its role in investment strategies is evolving. What does this mean for the future of both Bitcoin and your investment choices?

As Bitcoin continues to evolve, you might wonder how its relationship with Wall Street has changed over time. Initially, Bitcoin was viewed as a decentralized alternative to traditional financial systems, attracting early adopters who sought to challenge the status quo. However, Wall Street remained skeptical, largely due to Bitcoin's notorious volatility and the lack of regulatory oversight. This skepticism was a common theme in the early days, as many investors hesitated to embrace what they saw as a risky asset.

Over the years, though, that perception began to shift. Institutional investors started to show genuine interest in Bitcoin, recognizing its potential as a new asset class. Major exchanges developed Bitcoin trading platforms, marking a significant step toward mainstream recognition. This legitimization process gained momentum as large financial institutions entered the space, lending credibility to Bitcoin in the eyes of traditional investors.

Institutional interest in Bitcoin has surged, transforming it into a recognized asset class and gaining credibility among traditional investors.

Now, the correlation between Bitcoin and U.S. stocks has reached unprecedented levels, indicating that both assets respond to shared macroeconomic influences. You'll find that global economic announcements, like interest rate changes, affect both Bitcoin and the stock market. The increasing presence of financial institutions within Bitcoin markets has aligned its movements with those of traditional assets, creating a more interconnected financial landscape. Notably, the high correlation coefficient between Bitcoin and American stocks reflects this growing alignment. Furthermore, diversification across various cryptocurrencies can help investors manage the risks associated with Bitcoin's volatility.

Despite this increased stability, Bitcoin remains more volatile than most traditional assets, making it essential for investors to keep an eye on economic indicators. BlackRock's involvement in Bitcoin showcases the growing demand for digital assets among institutional investors. The introduction of Bitcoin ETFs has further stabilized the market by boosting trading volumes, allowing you to navigate the cryptocurrency landscape with a bit more predictability.

As Bitcoin becomes a diversifier in traditional investment portfolios, it's clear that market sentiment plays a crucial role in shaping its price trajectory. The regulatory environment also plays a significant role in Bitcoin's evolving relationship with Wall Street. The SEC's approval of spot Bitcoin ETFs in 2024 marked a major milestone, as increased regulatory oversight has led to more compliance and transparency in the markets.

This mainstream acceptance has helped manage risks associated with cryptocurrency investments, with ongoing regulatory developments promising to shape Bitcoin's market dynamics even further.