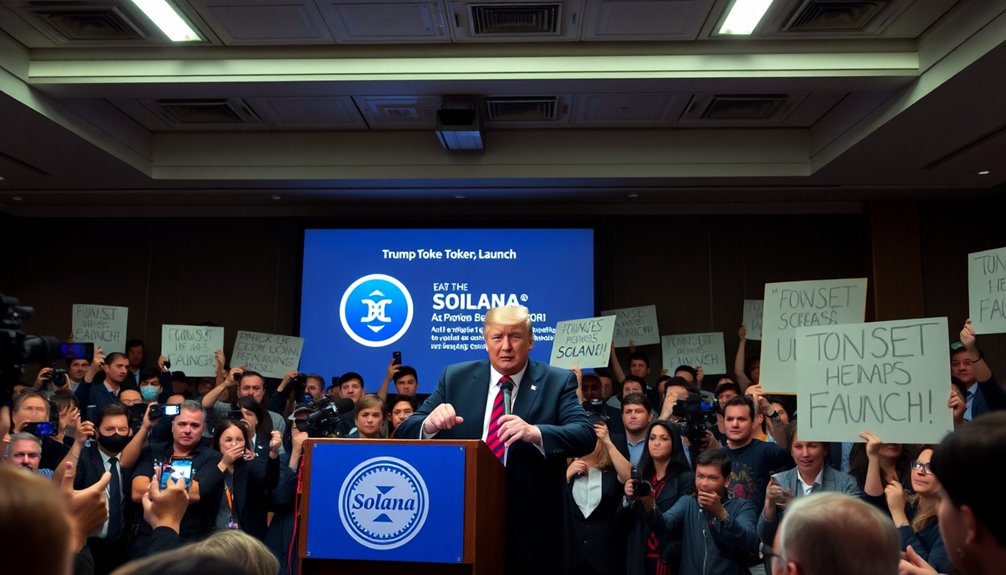

The launch of the Trump Solana token's faced backlash due to allegations of nepotism and potential conflicts of interest. Critics point out that nearly 90% of the token supply is held in a single wallet, raising concerns about insider control and market manipulation. Additionally, the legal scrutiny surrounding the token's compliance with the Emoluments Clause adds to the controversy. With its rapid rise to a peak market cap of $15 billion, the situation has drawn attention to the ethical implications of intertwining campaign donations and digital assets. Stick around to uncover more about this unfolding drama.

Key Takeaways

- The $MELANIA token launch raised concerns about transparency and potential insider control due to 90% of the supply being held in a single wallet.

- Allegations of nepotism surfaced with connections between Trump's campaign and the token launch, fueling ethical scrutiny among investors.

- Legal implications related to the Emoluments Clause and market manipulation risks intensified backlash against the token's structure.

- The popularity of the $TRUMP meme coin, which peaked at a $15 billion market cap, highlighted planning issues and investor doubt.

- Regulatory uncertainty regarding the classification of tokens as securities or commodities adds to the controversy surrounding the launch.

Token Launch Controversy Unfolds

As the $MELANIA token launch unfolded, it quickly became mired in controversy, raising questions about its ethical implications. You'd notice the lack of transparency in its tokenomics, which didn't align with what was advertised. The fact that nearly 90% of the token supply sat in a single wallet fueled allegations of nepotism and insider control. Emotional alignment is crucial in navigating such controversies, as it can help investors and communities maintain a grounded perspective amidst the chaos. Despite controversy, $TRUMP became a popular meme currency, suggesting a troubling disregard for thorough planning and ethics. You might also see how the launch negatively affected $TRUMP's price, resulting in significant market instability.

Legal Scrutiny Intensifies Over Token

Legal scrutiny around the $MELANIA token is intensifying, raising significant constitutional and regulatory concerns.

The token's structure challenges traditional interpretations of the Emoluments Clause, with its automated system aimed at increasing transparency in foreign participation. Blockchain analysis could help prove foreign involvement, addressing prior procedural hurdles.

However, the concentration of ownership raises potential market manipulation risks, while regulatory uncertainty looms over its classification as a security or commodity. Additionally, the SEC's recent actions against major exchanges could impact the token's legal standing.

Moreover, the token's launch was accompanied by a market cap of nearly $6 billion within 24 hours, highlighting the significant financial stakes involved.

With ongoing state-level scrutiny and limitations in investigative tools, the path ahead for the $MELANIA token faces considerable legal challenges, complicating its future in the crypto market.

Crypto Market Volatility Factors

While the crypto market can offer lucrative opportunities, its volatility is often driven by a combination of factors that investors need to understand.

Market sentiment plays a significant role; positive news can boost prices, while negative developments lead to rapid declines. Social media amplifies this effect, as real-time updates trigger immediate reactions.

Emotional trading fueled by fear or greed exacerbates price swings, especially during speculative periods. Additionally, trading volume and liquidity significantly impact market dynamics; surges can cause swift price movements, while low liquidity can heighten volatility. Regulatory frameworks are essential as they enhance acceptance and investor trust, which can stabilize prices.

Regulatory announcements and government policies also create unpredictable shifts, further complicating the landscape.

Ultimately, navigating these factors is crucial for maintaining investor confidence and making informed decisions in the crypto market.

Corporate Investments in Blockchain

Given the transformative potential of blockchain technology, many corporations are prioritizing investments in this space.

In fact, 85% of financial services leaders view blockchain investment as a high priority for the coming year. Companies are keenly exploring various digital asset projects, including payments and transactions, with 67% delving into that area. Majority of leaders maintain a positive outlook on blockchain's future impact.

Key drivers for these investments include consumer demand for transparency and cost savings in infrastructure.

Security and regulatory concerns linger, influencing decisions on whether to build in-house technologies or partner with third-party vendors.

The outlook remains positive, as businesses recognize the high growth potential of blockchain and anticipate a future where most transactions shift to this technology.

Campaign Donations and Token Launch

As corporations increasingly invest in blockchain technology, the political landscape is also embracing digital assets, particularly through campaign donations.

The Trump campaign's acceptance of cryptocurrencies like bitcoin and ether allows supporters to contribute via platforms like Coinbase Wallet and MetaMask. Since June 2024, the Trump 47 PAC has raised over $7.5 million in crypto donations, with notable figures like Cameron and Tyler Winklevoss leading the charge.

Meanwhile, the launch of the $TRUMP meme coin on the Solana blockchain has generated significant buzz, peaking at a market cap of $15 billion. This surge in interest is reflected in the coin’s current market cap of approximately $9. 36 billion. The excitement surrounding the $TRUMP meme coin has led to increased trading volumes and speculation about its future performance. Analysts are conducting a thorough solana alltime high analysis to understand the factors driving this momentum, including social media trends and investor sentiment. As more traders enter the market, the potential for further price fluctuations and new records looms large.

However, the intertwining of campaign donations and crypto projects raises eyebrows, prompting critics to question whether these moves serve political or personal interests.

Regulatory Changes Impacting Crypto

Regulatory changes are poised to reshape the crypto landscape significantly, especially with the anticipated shift in enforcement strategies under the Trump administration. You can expect a reversal of the SEC's aggressive actions, focusing more on fraud cases rather than non-registration issues. This could bring potential no-action guidance for DeFi platforms, easing existing regulatory uncertainty. Hester Peirce's proposal for a more lenient framework might also gain traction. With the FIT 21 Act clarifying the SEC and CFTC's jurisdiction over digital assets, you'll see increased capital market activity. Additionally, leveraging data analytics can help stakeholders navigate the evolving regulatory environment effectively. Plus, the support from pro-crypto Congress members suggests a favorable environment for these changes, ensuring clearer regulations and potentially invigorating the industry's growth. Additionally, the launch of the Official Trump meme coin has sparked renewed interest in cryptocurrency, which may influence regulatory discussions.

Frequently Asked Questions

What Is the Purpose of the Trump Solana Token?

The purpose of the Trump Solana Token is to express support for specific ideals while engaging the crypto community.

It aims to attract new users to Solana through social media and community stories, while its associated artwork visually represents the project.

Additionally, the token thrives on market speculation, offering potential quick gains but also risks of price volatility.

Its launch significantly impacts the Solana network, enhancing market activity and interest.

How Can Individuals Purchase the Trump Solana Token?

Imagine diving into a digital gold rush; you can snag the Trump Solana Token easily.

To purchase, sign up on the Moonshot app, deposit funds, and receive your tokens. Alternatively, open an account on major exchanges like Binance or Kraken, fund your wallet, and place your order.

If you're feeling adventurous, create a wallet and swap Solana for $TRUMP on a decentralized exchange.

It's all about finding the method that suits you best!

Who Are the Key Figures Behind the Token Launch?

The key figures behind the token launch include Donald Trump, who promotes the $TRUMP meme coin, and affiliates like CIC Digital LLC and Fight Fight Fight LLC, both owning 80% of the token supply.

These entities collaborated on the launch, which significantly impacted the market.

Other notable players in the Solana ecosystem, such as Jupiter and Meteora, also participated, contributing to the token's rapid rise in value and market interest.

What Are Potential Risks of Investing in the Token?

Investing in the Trump Solana Token could feel like riding a rollercoaster; the thrill comes with risks.

You're facing extreme volatility, driven largely by speculation and social media buzz. FOMO can lead you to make hasty decisions, while market manipulation lurks in the shadows.

Regulatory uncertainties add another layer of concern, and security threats like smart contract vulnerabilities could jeopardize your investment.

Be cautious; the potential for significant losses is real.

Will the Token Offer Any Unique Features or Benefits?

Yes, the token offers several unique features and benefits.

You can earn substantial staking rewards, which incentivize community engagement.

It also includes a FUD shielding mechanism to protect you from scams and false information.

With a Wall Builder liquidity pool, your trades will have a stable foundation.

Plus, by holding exclusive NFTs, you gain voting rights and access to special events, enhancing your participation in the community.

Conclusion

In the grand circus of crypto, it seems nepotism and conflicts are the new trends. Who needs legitimacy when you've got connections, right? As Trump's Solana token stumbles, you've got to wonder if the real currency here is scandal. With legal eyes watching closely and the market swinging wildly, it's almost like watching a reality show where everyone loses. So, grab your popcorn and enjoy the show—because in this token launch, the drama's worth more than the dollars!