Crypto News

Elon Musk Ignites Baby Doge Frenzy: Is the BABYDOGE Hype Sustainable?

As Baby Doge surges post-Elon Musk’s endorsement, questions loom over the sustainability of this hype and its implications for investors.

Elon Musk's recent shout-out has definitely ignited the Baby Doge frenzy, causing its price to shoot up by over 75%. This excitement is driving a surge in trading volumes and new investors, but the reality is more complex. With nearly 99% of the coin held by whales, price movements can be unpredictable. While the community is growing and charitable initiatives are appealing, the sustainability of this hype remains uncertain. If you're curious about the factors influencing Baby Doge's future and what it all means for you, there's a lot more to explore in this evolving landscape.

Key Takeaways

- Elon Musk's tweets significantly influence Baby Doge Coin's price, causing volatility and rapid price surges among investors.

- Whale ownership at 98.99% limits price movement, contributing to ongoing volatility and speculative trading behavior.

- The growing community, with over 1.3 million token holders, reflects increasing interest, but sustainability of hype remains uncertain.

- Recent listings and bullish predictions suggest potential price increases, though market sentiment remains unpredictable and complex.

- Charitable initiatives and technological developments enhance community engagement, but long-term growth depends on sustained investor interest and market dynamics.

Triggering the Baby Doge Frenzy

In early December 2024, a cryptic tweet from Elon Musk sent Baby Doge Coin's price soaring over 75%. The price jumped from a 24-hour low of $0.000000002443 to a high of $0.000000004448, marking a 10-month peak for the coin. Within just 24 hours, Baby Doge experienced an incredible 82% increase, fueled by Musk's enigmatic message.

Musk's tweet featured a black-and-white, Godfather-inspired image with the words "Dogefather" and "Dogeson," alongside a photo of him and his son. The official Baby Doge account quickly replied, asking, "You mean babydoge?" This sparked excitement and speculation among the community. Meanwhile, the Baby Doge team acknowledged the unpredictability of Musk's posts and their impact on price movements. As the market reacts to such events, projections indicate that the expected price for Baby Doge Coin in 2025 could reach $0.82551. Additionally, the current whale ownership stands at 98.99% of the total circulating supply, which could limit future price movements.

Despite the surge, whale activity indicated cautious optimism, as these entities control nearly 99% of the circulating supply. Spot netflows revealed a decrease of $2.51 million, but open interest in derivatives climbed to $2.41 million, indicating heightened trading interest. With the number of Baby Doge addresses also rising considerably, the community's engagement seems to be gaining momentum.

Musk's Influence on Crypto Markets

Elon Musk's impact on the crypto markets is nothing short of explosive, often triggering dramatic price swings with just a single tweet. His influence has transformed how investors view cryptocurrencies, especially meme coins like Dogecoin and Baby Doge Coin. You might find it astonishing how quickly sentiment can shift based on his social media activity.

Here are three key ways Musk shapes the market:

- Price Volatility: Just one tweet can cause Bitcoin's price to skyrocket or plummet, leading to increased anxiety among investors. This volatility is often exacerbated by influential figures like Musk, whose statements can create ripples across the entire market. The overall market dynamics can shift rapidly, making it essential for investors to be aware of asset performance in such a fluctuating environment.

- Mainstream Acceptance: Tesla's $1.5 billion investment in Bitcoin helped legitimize it, attracting institutional interest and boosting confidence in the entire crypto space. This move marked a significant step toward institutional adoption of cryptocurrencies, encouraging other companies to explore similar investments.

- Meme Coin Mania: His playful endorsements have created a frenzy around meme coins, pushing prices up dramatically and drawing in new investors keen to ride the wave.

This "Elon effect" highlights the cryptocurrency market's vulnerability to high-profile endorsements. While the excitement can create opportunities, it also poses challenges as the market grapples with volatility and potential regulatory scrutiny. Your investment strategy must adapt to this ever-changing landscape.

Price Surge and Market Performance

You can't help but notice Baby Doge's recent price surge, skyrocketing by over 60% in just a week. With a current market cap around $159.71 million and trading volume hitting approximately $81.96 million, the momentum is undeniable. As you assess these numbers, it's clear that the market is buzzing with excitement and speculation about what's next. This surge can be attributed to the strong interest from investors reflected in the growing market cap. Additionally, the current market cap of BABYDOGE stands at $701.71 million, showcasing its significant presence in the cryptocurrency market.

Significant Price Increase

Amid recent market fluctuations, Baby Doge Coin has experienced a remarkable price surge, drawing significant attention from investors. Over the past week, the coin's price skyrocketed by around 60.01%, with a staggering 67.83% jump just in the last 24 hours. This surge was particularly fueled by an electrifying tweet from Elon Musk, propelling the coin more than 75% higher. Expected peak price could reach $0.00000000930 soon.

This newfound excitement has led many to take notice, and it's hard not to feel the thrill of the ride. Here's what's got people buzzing:

- Community Impact: The coin's rise is largely driven by passionate community support and social media hype.

- Trading Volume Spike: With a 24-hour trading volume of around $2.81 million, enthusiasm is palpable.

- Celebrity Influence: Elon Musk's tweet acted as a catalyst, reminding everyone of the power of social media in crypto markets. Recent comments by Musk have triggered a surge in Baby Doge coin interest.

While the current price sits at approximately $0.000000004000, it's important to remember that Baby Doge Coin's journey is marked by volatility, making its future performance a topic of keen interest.

Market Cap Predictions

Following the recent price surge, attention now turns to market cap predictions for Baby Doge Coin and its overall market performance. Currently, the market cap stands at $373.47 million, with a circulating supply of 160.18 trillion BabyDoge tokens. Investors are keenly watching for bullish trends, predicting prices could climb to between $0.000000003819 and $0.000000006317 by 2024. If positive sentiment holds, a potential high of $0.000000007077 is conceivable. However, the market's mood can shift, with bearish predictions suggesting prices might dip to $0.000000001129 if unfavorable conditions arise. To maintain upward momentum, the price needs to reclaim the essential level of $0.000000002976, while support and resistance levels at $0.000000001874 and $0.000000002685 will also play significant roles in guiding future movements. Elon Musk's influence has undeniably sparked interest, but the reality is that 98.99% of the circulating supply is controlled by whales. For sustained growth, retail demand will be vital, and the number of addresses holding Baby Doge is increasing, hinting at potential upward trajectories in the market. Additionally, the current trading volume of $48.24 million reflects active participation from investors, which is crucial for maintaining momentum. Furthermore, the Baby Doge Coin dApp has recorded 100.85K transactions in the last 30 days, indicating growing user interest and engagement. As the cryptocurrency landscape evolves, understanding market volatility remains essential for investors navigating potential risks and rewards. Given the high level of community engagement, the support from investors could lead to a more stable price floor for Baby Doge Coin. Implementing sound risk management strategies is critical for investors looking to capitalize on market fluctuations without incurring significant losses. Successful brands often leverage data-driven marketing strategies, which could also be beneficial for Baby Doge's growth trajectory.

Trading Volume Surge

Recently, Baby Doge Coin experienced a remarkable trading volume surge, with a staggering 1,330% increase in just 24 hours, pushing volumes to over $105.27 million. This surge didn't just stop at volume; the price shot up nearly 55% in the same timeframe. It's clear that the excitement surrounding Baby Doge is palpable.

Here are three reasons you should be paying attention:

- Community Buzz: A post from Elon Musk ignited interest, driving demand to new heights.

- New Listings: Recent listings on Binance opened doors for more investors, further fueling the frenzy.

- Deflationary Model: The built-in deflationary mechanism guarantees that the supply diminishes over time, potentially increasing value.

In just 24 hours, Baby Doge's price surged over 80%, marking a 10-month high. The number of addresses holding Baby Doge has doubled since the start of 2024, indicating strong retail interest despite whale dominance. Additionally, the surge in trading volume reflects a broader interest in meme coins within the market, further emphasized by the projected 40% CAGR growth in AI tech, which could enhance trading platforms. As this hype continues, it raises questions about sustainability and future performance in the market, especially considering the rounded bottom pattern that signals a bullish reversal. Will you join the frenzy, or will you wait for the dust to settle?

Market Cap and Trading Volume Insights

You'll find that Baby Doge's trading volume recently surged to $581 million, highlighting a significant shift in market activity. This spike not only reflects investor enthusiasm but also hints at potential market cap projections moving forward. As you consider the implications, keep an eye on how these dynamics might affect future price movements and trading patterns. With a current market cap of $274,507,474.25, Baby Doge's growth trajectory appears promising. Additionally, the recent 76% price increase demonstrates strong bullish momentum that could attract further investment.

Recent Trading Volume Surge

In just 24 hours, Baby DogeCoin's trading volume skyrocketed by an astonishing 1,330%, surpassing $105.27 million. This surge not only reflects heightened interest but also resulted in a remarkable 55% price jump, pushing the coin to $0.000000001604. Such dramatic movements indicate a newfound enthusiasm among traders and investors alike. This meteoric rise has reignited conversations around the potential of meme-inspired cryptocurrencies to yield significant returns, drawing comparisons to early Dogecoin success stories. As excitement builds, many are turning to strategies shared by seasoned investors, often referred to as “dogecoin millionaire tips for success,” to navigate the volatility and maximize gains. Whether through strategic timing, diversification, or holding through market fluctuations, these insights are becoming invaluable for both newcomers and seasoned traders in the space.

Here are three key takeaways from this surge:

- Record-Breaking Volume: The volume increase signals a strong buying frenzy, showcasing the coin's growing traction in the crypto market.

- Major Exchange Listings: With Baby DogeCoin now available on Binance and other platforms, visibility has skyrocketed, drawing in both retail investors and institutional interest. The recent market cap increase from $180 million in January to approximately $447 million demonstrates the coin's rising prominence.

- Whale Activity: The dominance of whales, controlling nearly 99% of the supply, adds a layer of intrigue and volatility, as their movements can greatly impact prices. Furthermore, this increased market awareness is crucial for potential investors in Baby DogeCoin.

The recent trading activity paints a vibrant picture of Baby DogeCoin's potential, but it also raises questions about sustainability. Can this explosive growth maintain momentum, or will it fizzle out as quickly as it ignited?

Market Cap Projections Ahead

The recent surge in trading volume has set the stage for a closer look at Baby DogeCoin's market cap projections. Currently, its market cap stands at approximately $392.81M, fluctuating between $373.47M and $402.30M based on various sources. This volatility indicates a dynamic market response and can reflect investor sentiment. Historical data shows that Baby Doge's market cap has been lower, suggesting room for growth if it gains more traction and community support. Additionally, the Baby Doge Coin community consists of 1.3 million token holders, highlighting its widespread appeal and potential for further expansion. Notably, Baby Doge has been traded more frequently than BNB on Binance, showcasing its rising popularity. Moreover, the increased cryptocurrency adoption can lead to greater investor confidence and participation in the market.

As you analyze future market cap predictions, keep in mind that no specific long-term forecasts are available. However, advancements within the ecosystem and overall cryptocurrency adoption could positively influence its value. Significant gains are possible if Baby DogeCoin reaches new all-time highs, enhancing its market capitalization.

Trading volume insights further illustrate the current market activity, with a 24-hour trading volume of $81.96M, showcasing heightened interest. High trading volumes typically signal potential price movements, making them an essential metric for understanding market dynamics. To conclude, while the hype around Baby DogeCoin is palpable, its sustainability will largely depend on market conditions and ongoing developments within the community.

Unique Utilities of Baby Doge

How does Baby Doge stand out in the crowded crypto landscape? Its unique utilities set it apart, transforming the way you engage with cryptocurrency. Here's what makes Baby Doge special:

- Real-World Payments: Integrated with Coinpayments, you can use Baby Doge for purchases on major e-commerce platforms like WooCommerce and Shopify, making your crypto experience practical and accessible. Additionally, the project has established partnerships with various charities, enhancing its visibility and appeal. This integration helps to bridge the gap between traditional finance and cryptocurrency adoption, creating more opportunities for users. Moreover, the use of air purifiers in homes reflects a growing trend towards improving indoor environments, similar to how Baby Doge aims to improve financial landscapes. Investing in cryptocurrencies can also provide tax advantages similar to those found in Gold IRA accounts. Furthermore, transactions using Baby Doge may be subject to IRS regulations, ensuring compliance and security in the evolving digital currency landscape.

- Charity Focus: Baby Doge isn't just about profits. It supports animal rescue organizations like ASPCA and Best Friends, allowing you to contribute to meaningful causes while you trade. This charitable approach aligns with the project's goal of becoming the first cryptocurrency dedicated to charity and community engagement.

- Innovative Features: With the Baby Doge Card and mobile app, you can make crypto payments directly using credit cards. Plus, its NFT marketplace and BabyDogeSwap offer exciting avenues for trading and creativity. These features enhance the overall user experience and provide added value in a competitive market.

These utilities create a tangible impact in your daily life, whether you're purchasing goods or supporting animal welfare. Baby Doge isn't just another token; it's a movement with real applications that resonate with your values. The question is, are you ready to be part of this unique ecosystem?

Engaged Community and Growing Holders

Baby Doge's vibrant community and rapidly growing holder base are key to its success in the competitive crypto market. With over 880,000 Twitter followers and more than 200,000 members on Telegram, the engagement is impressive. The Baby Doge Swap account alone has tweeted 3,552 times since its inception, showcasing its commitment to keeping you informed and involved. Users are actively creating AI Baby Doge characters and minting them into NFTs, which enhances community interaction. Additionally, the rise of cybersecurity vulnerabilities in the crypto space emphasizes the importance of secure transactions within such communities. Furthermore, the community's enthusiasm mirrors the raw food diets that emphasize fresh, unprocessed ingredients, promoting a healthier lifestyle. In fact, the community's shared love for dogs resonates with the bond between humans and dogs, further solidifying their connection. Notably, many members are also passionate about high-quality protein sources in pet food, which aligns with their commitment to animal welfare. The community's dedication to maintaining optimal moisture levels in their plant care practices reflects a broader interest in responsible and sustainable living.

The holder base is also expanding considerably. Since January 2024, the number of Baby Doge coin addresses has surged from under 16,000 to 33,680, and 1. 3 million token holders are now part of this growing ecosystem. Although the top 100 holders control 99. 47% of the supply, retail participation is climbing, indicating a more diverse holder landscape. In addition, the exchange’s trading volume has shown a 21. 83% increase, reflecting heightened interest in the token. Moreover, the community’s commitment to animal welfare charities has further strengthened its engagement and purpose. The upcoming Minotaurus token presale milestone is also expected to bring even more attention and investment to the Baby Doge coin ecosystem. With the increasing number of token holders and expanding retail participation, the diverse holder landscape is likely to continue growing. The community’s dedication to supporting animal welfare charities, coupled with the excitement around the Minotaurus token presale milestone, showcases a strong sense of purpose and commitment within the Baby Doge coin community.

Transaction activity reflects this enthusiasm, with over 100,000 transactions recorded in the last month, marking a 111.61% increase. Despite some volume fluctuations, the continuous rise in transaction counts shows that Baby Doge is not just a passing trend but a community-driven movement with staying power.

Recent Developments and Roadmap Ahead

You'll want to keep an eye on the upcoming feature launches that Baby Doge has lined up, as they promise to enhance user experience and engagement. The team is also focusing on community initiatives and market strategies aimed at solidifying its presence in the crypto space. With clear goals in sight, Baby Doge is gearing up for an exciting future that could reshape its ecosystem. The integration with Coinpayments for e-commerce payments will also broaden the utility of Baby Doge Coin in real-world transactions. Additionally, the recent introduction of the Baby Doge NFT as an in-game cosmetic item will further attract players and investors alike.

Upcoming Feature Launches

With exciting developments on the horizon, the Baby Doge community can look forward to a series of innovative feature launches that promise to elevate user engagement and creativity. One of the most anticipated features is the BabyDoge AI Image Generator, launching on December 6th. This tool will enable users to create unique Baby Doge images using advanced AI technology, sparking creativity like never before. Additionally, the recent surge in Baby Doge Coin's price following Elon Musk's tweet has generated significant market interest.

Here are three key features to get excited about:

- Solana Network Integration: Baby Doge Coin is expanding its reach with a renounced token contract on the Solana network, enhancing multi-chain compatibility. This integration could help boost color accuracy in the NFT marketplace, providing vibrant and engaging visuals for users. Furthermore, this move aligns with the trend of utilizing blockchain technology to enhance security and transparency in transactions.

- BabyDoge NFT Marketplace: This platform will allow users to explore, create, and trade exclusive NFT collections featuring Baby Doge characters, boosting the NFT trading ecosystem.

- Gameplay Enhancements: Expect continual updates and new games, including a chess game and improvements to BabyDoge PAWS, keeping users engaged through fun, interactive experiences. Additionally, the team is focused on building a strong, engaged community, which will further enhance user involvement and satisfaction.

These upcoming launches not only promise to enhance the Baby Doge ecosystem but also encourage creativity and community involvement. Don't miss out!

Community Engagement Initiatives

Community engagement initiatives have taken center stage in the Baby Doge ecosystem, fostering a vibrant and active user base. You'll find that the community thrives on social media platforms like Telegram, Twitter, and Instagram, where users can connect and share their passion for blockchain technology and animal welfare. The official Discord server features dedicated channels for various discussions, making it easy for you to get involved.

Recent partnerships with organizations like Paws with Cause and the ASPCA highlight Baby Doge's commitment to animal rescue efforts. You might appreciate the substantial donations made to support medical care and adoption initiatives. Community-driven charity campaigns encourage you to engage directly with animal welfare organizations through donations or volunteering, reinforcing the project's socially responsible image. Additionally, the project has garnered a strong community backing with over 1.3 million token holders, which further strengthens its impact on animal welfare. The project also emphasizes charitable donations, particularly for animal welfare initiatives, showcasing its commitment to giving back.

To boost user participation, Baby Doge has established forums and chat rooms for your interaction and feedback. Regular community events guarantee that your voice is heard in shaping the project's direction. Recent developments, including the expansion to the Solana network and the launch of puppy.fun, further showcase the active involvement of the community in driving growth and innovation.

Market Strategies and Goals

Recent developments in Baby Doge's market strategies reflect a robust plan aimed at increasing visibility and utility. The recent listing on Binance has greatly boosted trading volume and visibility, driving a remarkable 137% price increase in just a week. With a current trading price of $0.000000002392 and a 24-hour trading volume surpassing $97 million, the momentum is palpable.

Here's what you should be excited about:

- Strategic Partnerships: Collaborations with major exchanges and Shopify are enhancing liquidity and allowing real-world transactions with BABYDOGE. Additionally, the strong community presence with over 2.6 million followers on X is pivotal for sustained interest and engagement. The team's commitment to significant donations pledged to animal-related charities further strengthens community bonds and attracts socially conscious investors. This commitment echoes a broader trend in the industry where socially conscious investment is becoming increasingly influential among cryptocurrency enthusiasts.

- Practical Applications: The roadmap includes developing applications that offer real utility, expanding Baby Doge's reach beyond just being a meme token.

- Community-Driven Growth: With 85% of technical indicators signaling bullish trends, the community's support is essential for achieving a target price of $0.000000007077 by the end of 2024.

As Baby Doge positions itself for long-term success, the focus on utility and real-world applications promises to attract more investors, paving the way for sustainable growth. Don't miss out on this evolving journey!

Analyzing Hype Sustainability Factors

As speculative behavior continues to drive the hype around cryptocurrencies like Baby Doge, understanding the factors influencing its sustainability becomes important. You'll notice that Elon Musk's tweets often trigger rapid price surges, creating an atmosphere ripe for volatility. This environment, fueled by hype and FOMO, results in price spikes—like the recent 82% increase in just 24 hours. However, history shows these rallies are typically short-lived, with prices correcting sharply once the initial excitement fades. Additionally, Baby Doge's market cap stands at $0.2 billion, which highlights its significant presence as a new cryptocurrency. Notably, the average time to mine 1 Bitcoin is approximately 10 minutes per block, which reflects the energy-intensive nature of cryptocurrency mining. Furthermore, it is crucial for investors to consider establishing clear savings goals to navigate the volatile landscape of cryptocurrencies.

Environmental sustainability also plays a significant role. The energy-intensive mining processes associated with meme coins raise concerns about their carbon footprint, potentially leading to regulatory scrutiny. As regulations surrounding intellectual property evolve, investors may face additional risks that could impact market dynamics. Without robust regulations, excessive speculation can erode trust and hinder long-term sustainability. Moreover, the high energy consumption linked to cryptocurrencies like Bitcoin raises further questions about the viability of such investments. Diversification can also help mitigate risks associated with volatile assets like Baby Doge.

Additionally, the maturity of the crypto market is essential. Investors need education on fundamental analysis to make informed decisions, rather than relying on social media buzz. As the market matures, the integration of eco-friendly practices and reliable market strategies becomes important for fostering a more sustainable future for Baby Doge and similar cryptocurrencies.

Whale Activity and Market Sentiment

Amid the swirling dynamics of the cryptocurrency market, whale activity plays a pivotal role in shaping market sentiment for Baby Doge. With an astonishing 98.99% of the total circulating supply held by whales, you're witnessing a scenario where their decisions can dramatically influence prices. This concentration hints at an anticipation of heightened retail demand, creating a sense of urgency among investors.

Consider the following:

- Massive Price Fluctuations: When whales decide to trade, the resulting price shifts can be extreme, leading to both excitement and anxiety in the market.

- Elon Musk's Influence: Musk's tweet triggered a jaw-dropping 75% price surge, showcasing how social media can send shockwaves through the market. Additionally, the recent listing of BABYDOGE on Binance has further increased its visibility and market accessibility.

- Growing Retail Interest: As Baby Doge addresses soared from 16,000 to 33,680, it reflects a budding enthusiasm among retail investors, keen to join the frenzy. Additionally, the recent surge in whale transactions indicates a strong interest from large-scale holders, further complicating market dynamics.

The interplay of whale control and market sentiment creates a volatile environment. You can feel the tension as investors watch closely, hoping for another surge while bracing for potential downturns driven by whale actions.

Long-Term Prospects for Baby Doge

What does the future hold for Baby Doge? The long-term prospects seem promising, especially with a thriving community of over 3.6 million followers on X. This active engagement is vital for sustaining interest and driving potential price breakouts. However, the relatively low Discord following raises questions about genuine engagement versus bot activity.

Technologically, Baby Doge's expansion to the Solana network and the launch of initiatives like Baby Doge Swap and BabyDogeNFT enhance its utility. Future listings on major exchanges could further boost visibility and trading activity, evidenced by its recent Binance listing that triggered a 137% price increase. The token is designed as a deflationary token, which may enhance its value over time as supply diminishes.

Price predictions vary, with DigitalCoinPrice forecasting an average of $0.0000000156 by 2030, while WalletInvestor suggests a bearish outlook. Volatility remains a concern, as market sentiment can swing drastically, influenced by external factors, including social media buzz.

Ultimately, Baby Doge's long-term success hinges on community engagement, technological advancements, and market conditions. The crypto landscape is unpredictable, but if the current bullish sentiment continues, Baby Doge might just carve out a sustainable niche in the market.

Frequently Asked Questions

What Is Baby Doge's Origin and Mission?

Baby Doge originated on June 1, 2021, as part of the dog-themed cryptocurrency trend, inspired by the popular Shiba Inu meme. Built on Binance's BNB Chain, it aims to support dog welfare globally. You'll find that it partners with various animal welfare organizations, donating over $1.2 million to rescue efforts. With a mission to empower shelters through cryptocurrency, Baby Doge combines community engagement and charity to create a positive impact.

How Can I Buy Baby Doge Tokens?

"Where there's a will, there's a way." To buy Baby Doge tokens, start by selecting a safe exchange that lists them. Verify your account and purchase BNB or ETH as your base currency. Set up a Web 3.0 wallet, then connect it to a DEX like PancakeSwap. Enter the amount of Baby Doge you want to swap, confirm the transaction, and don't forget to store your tokens securely in a hardware wallet.

What Makes Baby Doge Different From Other Meme Coins?

Baby Doge stands out from other meme coins due to its unique blend of features and community engagement. It operates on the Binance Smart Chain, offering fast transactions and low fees. The hyper-deflationary model rewards you for holding by redistributing tokens and continuously burning supply. Plus, it provides real-world utility, like a crypto credit card and partnerships for spending on various platforms. The active community and innovative projects further enhance its appeal.

Are There Risks Associated With Investing in Baby Doge?

Imagine diving into a sea of bright, shimmering coins, only to find hidden currents pulling you under. Investing in Baby Doge isn't without risks. You're exposed to wild price swings driven by social media hype, potential scams lurking around every corner, and the threat of losing your staked tokens to technical vulnerabilities. You need to tread carefully, weighing the allure of quick gains against the reality of an uncertain and volatile market.

How Does Baby Doge Plan to Use Its Funds?

Baby Doge plans to use its funds primarily for charitable donations, supporting animal shelters and rescue groups. You'll see a portion of transaction fees allocated to these causes, ensuring transparency in fund usage. Additionally, the project invests in its development, creating a decentralized swap platform and a Paw Wallet for tracking rewards. Engaging the community in decision-making about fund allocation strengthens its mission to help dogs in need while enhancing user experience.

Conclusion

In the whirlwind of Baby Doge's rise, you're caught in a tempest of excitement and uncertainty. Just like a shooting star, its brilliance dazzles, but can it endure the vast night sky? As you navigate this crypto landscape, keep an eye on the winds of market sentiment and whale activity. The future remains a canvas, waiting for your brushstrokes of insight and caution. Will Baby Doge's hype evolve into a lasting legacy, or fade like so many fleeting sparks?

Hans’s journalism and editorial leadership background at HARTSBURG NEWS has honed his ability to present information in a credible, well-structured manner. He prioritizes thorough research and factual accuracy, ensuring readers can rely on our coverage.

Crypto News

PBOC Report Highlights Crypto Oversight, Hong Kong Takes the Lead With Licensing Initiatives

With China’s strict crypto regulations and Hong Kong’s innovative licensing, the future of virtual assets remains uncertain—what might this mean for global investments?

The PBOC's recent report emphasizes China's strict crypto regulations while highlighting Hong Kong's innovative licensing initiatives. Despite China's outright ban on cryptocurrency trading, Hong Kong's framework encourages the growth of virtual asset service providers. By requiring compliance with rigorous KYC/AML standards, the Hong Kong Securities and Futures Commission ensures a safe environment for investors. This proactive approach positions Hong Kong as a leader in crypto oversight and market growth. As regulations evolve, the crypto landscape continues to shift, revealing more about the future of this dynamic sector and how it affects global investments.

Key Takeaways

- The PBOC's report emphasizes China's strict ban on cryptocurrency trading to maintain economic stability and prevent financial risks.

- Hong Kong has established a licensing framework for virtual asset service providers, enhancing regulatory oversight and consumer protection.

- The Securities and Futures Commission in Hong Kong enforces KYC/AML compliance with significant penalties for non-compliance, fostering a secure crypto environment.

- Hong Kong's expedited licensing process has attracted nearly 30 applications this year, indicating a proactive approach to crypto market growth.

- Global regulatory comparisons highlight Hong Kong's leading role amidst varied international frameworks, striving for clarity and investor confidence in the crypto sector.

Overview of PBOC's Report

Examining the recent report from the People's Bank of China (PBOC) reveals a comprehensive analysis of the current state of cryptocurrency regulation. Published as part of the China Financial Stability Report 2024, this document takes a global perspective, discussing regulatory shifts and developments in the cryptocurrency market.

You'll find that the PBOC report highlights significant price increases in cryptocurrencies during 2023, a rebound following the crises of 2022. It notes that increasing regulations worldwide are driving heightened interest among investors.

However, the report also emphasizes the volatility and risks tied to cryptocurrency investments, reminding you that regulatory changes play a crucial role in shaping market dynamics. Furthermore, the report draws attention to Hong Kong's unique dual license system for digital asset exchanges as a significant regulatory development.

Additionally, the PBOC compares regulatory frameworks across countries, including the US, Europe, and Hong Kong. By addressing various international approaches, the report underscores the need for cohesive regulation in tackling the challenges posed by cryptocurrencies.

The insights from the PBOC provide a foundational understanding of the regulatory landscape, preparing you for a deeper exploration of China's specific stance on cryptocurrencies in subsequent discussions.

China's Stance on Cryptocurrencies

While many countries are exploring the potential of cryptocurrencies, China has taken a firm stance by implementing a strict ban on their trading and use since September 2021. This ban includes prohibitions on cryptocurrency exchanges and token financing platforms, preventing any exchange between legal currency and tokens.

Financial institutions, including non-bank payment services, can't provide any support for token issuance or cryptocurrency transactions. Even insurance businesses are restricted from covering cryptocurrencies within their liability scope.

The government's concerns center on the potential destabilization of the Chinese economy and currency. They see cryptocurrencies as a threat that could replace fiat currency, disrupting financial stability. Additionally, initial coin offerings (ICOs) are classified as illegal fundraising methods that could facilitate criminal activities. As part of a broader trend, 51 countries have implemented bans on crypto assets globally, highlighting the growing regulatory caution.

To enforce these regulations, new foreign exchange rules require banks to monitor risky trades related to cryptocurrencies. The State Administration of Foreign Exchange oversees these measures to combat underground banking and cross-border gambling.

As of August 2024, there's no indication that the ban will be lifted, as China remains committed to developing its own digital currency, the e-CNY, while tightening its regulatory grip on cryptocurrencies.

Hong Kong's Licensing Framework

Hong Kong has established a comprehensive licensing framework for virtual asset service providers (VASPs) to ensure regulatory compliance and enhance financial security. To obtain a crypto license, you must declare your intent to operate in the Hong Kong market and pass a fit and proper test, which verifies your criminal record, AML/CFT history, and financial situation. You'll also need to nominate at least two responsible officers who are qualified to manage VA services. Your application must comply with the Securities and Futures Commission (SFC) procedures and include the necessary fees. You'll need to provide a detailed documentation package, including your business activity description and legal entity information. Importantly, you must maintain a local presence, which requires having at least one local director and compliance officer, along with a physical office. The regulatory frameworks introduced are enforced under the Anti-Money Laundering and Counter-Terrorist Financing Act, and failing to comply can lead to severe penalties, including fines up to HK$5,000,000 and imprisonment. Therefore, understanding and adhering to these requirements is crucial for operating legally and successfully in Hong Kong's crypto market.

Regulatory Measures in Hong Kong

The regulatory landscape for cryptocurrencies in Hong Kong is shaped by several key bodies and legislative frameworks aimed at ensuring compliance and security in the financial market.

The Securities and Futures Commission (SFC) plays a critical role by regulating securities and futures markets, including crypto interactions and enforcing KYC/AML compliance. The Legislative Council of Hong Kong approves legislation related to crypto regulations, while the Hong Kong Monetary Authority (HKMA) collaborates with the SFC on virtual asset regulatory approaches.

Key legislation, like the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO), mandates Virtual Asset Service Providers (VASPs) to comply with AML and CTF regulations. Recent updates to the SFC licensing framework emphasize the importance of rigorous compliance measures for all crypto firms operating in the region.

The Securities and Futures Ordinance (SFO) outlines requirements for market participants, establishing a framework for licensing VASPs. Applicants must demonstrate they're fit and proper to engage in providing virtual asset services.

Looking ahead, initiatives like the consultative panel for licensed virtual asset trading platforms (VATPs) and anticipated regulations for stablecoins reflect Hong Kong's commitment to consumer protection and compliance with international standards.

These measures position Hong Kong as a forward-thinking regulatory environment for digital currencies.

Global Comparison of Crypto Regulations

Across the globe, countries are adopting diverse regulatory frameworks to address the complexities of cryptocurrency.

In the European Union, the Markets in Crypto-Assets Regulation (MiCA) requires companies to obtain licenses and verify wallet ownership for transactions over 1,000 euros. This comprehensive regulation aims to protect investors and combat money laundering.

Conversely, the United States has a more fragmented approach, with the SEC and CFTC overseeing the sector but no comprehensive federal law in place—state regulations vary widely. The urgency for regulation has been heightened by recent bank collapses linked to crypto activities.

Brazil has recently appointed its central bank as the crypto supervisor, legalizing cryptocurrencies and regulating exchanges to prevent fraud.

Japan, on the other hand, recognizes cryptocurrencies as legal property, requiring exchanges to register with the Financial Services Agency and comply with AML/CFT obligations.

In Asia, Hong Kong is positioning itself as a crypto hub by allowing licensed exchanges to trade digital currencies with retail investors, ensuring that financial institutions incorporate these transactions into existing frameworks.

Meanwhile, South Korea mandates that exchanges register with the Korea Financial Intelligence Unit, with strict user protection measures in place.

Each country's unique approach reflects its regulatory priorities and economic context.

Impact on the Crypto Market

With new regulations taking shape, the crypto market is poised for significant transformation. You'll likely notice an influx of new entrants as the streamlined licensing process reduces application timelines and boosts transparency. The introduction of a consultative panel will enhance regulatory clarity, allowing licensed platforms to engage directly with regulators. Tax waivers on crypto gains aim to attract global asset managers and wealthy investors, increasing market participation. As part of this effort, authorities are also working on licensing requirements for crypto custodians, ensuring that digital assets are safeguarded effectively. Furthermore, the integration of decentralized control through blockchain technology will foster a more secure environment for transactions. Additionally, the push for renewable energy sources in crypto mining operations aligns with global sustainability goals.

Investor confidence is set to rise as robust regulations emerge, reassuring traditional financial institutions and retail investors alike. The dual license system for digital asset exchanges ensures compliance and supervision, while mandatory customer monitoring by major financial institutions adds an extra layer of security. You can expect the market to grow as existing crypto businesses expand and new players join in. The allowance for exchange-traded funds (ETFs) with direct exposure to digital assets like Bitcoin and Ether will further stimulate interest.

Future Developments in Hong Kong

Hong Kong's crypto landscape is set for a dramatic shift as an expedited licensing process rolls out next year, making it easier for trading platforms to enter the market.

This streamlined approach will reduce waiting times and simplify compliance procedures, attracting more participants. However, you should expect rigorous assessments of applicants' policies and systems, all certified by a qualified public accountant. The second-phase assessment will involve collaboration between the SFC and external assessors.

Regulatory framework enhancements will also play a crucial role in shaping the market. A consultative panel for licensed platforms will ensure sustainable innovation, while a proposed stablecoin framework will focus on fiat-backed options to bolster financial stability. Furthermore, the government aims to position Hong Kong as a global crypto hub by attracting international investors.

The SFC is set to implement a dual license system for digital asset exchanges, categorizing virtual assets under securitized and non-securitized financial assets.

Moreover, Hong Kong aims to attract global asset managers with potential tax waivers on crypto gains, positioning itself as a financial hub.

With nearly 30 applications received this year and four new exchanges already licensed, the future looks promising for crypto in Hong Kong, fostering trust, transparency, and stability in the sector.

Conclusion on Crypto Oversight

The evolving landscape of crypto oversight reveals a complex interplay of regulatory frameworks and challenges that demand careful navigation.

As you consider the implications of these regulations, it's clear that a global effort is essential. The EU's MiCA framework and the US's FIT21 bill illustrate differing approaches but share the common goal of consumer protection and regulatory clarity. Notably, the implementation of strict AML/KYC regulations highlights the increasing importance of compliance in maintaining market integrity.

Countries like Türkiye are tightening their grip on crypto asset service providers, emphasizing the importance of compliance in a rapidly evolving market.

However, consumer protection remains a significant concern, as lagging rules create vulnerabilities, especially in regions with high adoption rates but underdeveloped regulations.

The fragmented regulatory environment complicates compliance, making it paramount for businesses to stay informed about overlapping jurisdictions.

Hong Kong's dual licensing system stands out as a proactive measure, setting a precedent for other jurisdictions.

Frequently Asked Questions

What Are the Penalties for Violating Crypto Regulations in China?

If you violate cryptocurrency regulations in China, you could face serious penalties. Engaging in crypto transactions might land you in prison for up to 10 years and fines reaching $79,100.

Fundraising over 100,000 yuan could also lead to severe consequences, including lengthy prison sentences. Authorities actively crack down on illegal activities, so you need to be cautious.

Financial institutions are prohibited from participating in any cryptocurrency-related services, increasing your legal risks.

How Do Crypto Regulations Affect Individual Investors in Hong Kong?

Crypto regulations in Hong Kong significantly impact you as an individual investor.

You can only trade on licensed platforms, and to access these, your portfolio must exceed HKD 8 million. You'll need training to understand cryptocurrencies and can only invest in certain products.

While you can engage in peer-to-peer trading, restrictions on foreign ETFs limit your options.

The regulatory environment aims to ensure safe practices, affecting your trading flexibility and potential profits.

Are There Tax Implications for Crypto Transactions in Hong Kong?

Yes, there are tax implications for crypto transactions in Hong Kong.

You'll need to report profits from trading as business income, while any crypto received for goods or services is subject to standard corporate or salary taxes.

Capital gains from holding crypto aren't taxed, and you won't face GST or VAT on transactions.

Remember to declare everything on your tax returns, as the Inland Revenue Department enforces compliance.

What Is the Role of International Organizations in Crypto Regulation?

International organizations play a crucial role in crypto regulation by setting high-level recommendations and standards.

They focus on creating a technology-neutral approach, ensuring that similar activities face the same regulations.

By promoting cross-border cooperation and information sharing, they help prevent regulatory arbitrage and enhance oversight.

Additionally, they advocate for robust measures to prevent financial crimes, ensuring that governance and risk management standards align with the complexities and risks of crypto activities.

How Do Regulatory Changes Impact Crypto Innovation in Hong Kong?

Regulatory changes in Hong Kong significantly impact crypto innovation by creating a structured environment for digital asset trading.

You'll see that the dual licensing system encourages compliance while promoting market growth. This clarity attracts global firms, enhancing investor confidence.

With initiatives like the stablecoin issuer sandbox, you're likely to witness new products and services emerging.

Conclusion

In conclusion, the PBOC's report underscores the importance of regulatory oversight in the crypto space, with Hong Kong setting a strong example through its licensing initiatives. As you navigate this evolving landscape, staying informed about these developments will be crucial. The proactive measures in Hong Kong could shape the future of crypto regulations globally, offering both opportunities and challenges. Embracing these changes will help you make better decisions in your crypto ventures moving forward.

Thorsten has been immersed in the cryptocurrency world for several years. His early experiences as a miner and active market participant have given him first-hand knowledge of the industry’s highs and lows. Thorsten’s approach is grounded in transparency and honesty, ensuring our editorial direction remains authentic, accurate, and reader-focused.

Crypto News

Vietnam Cracks Down on $1 Million Crypto Scam, Saving Hundreds From Financial Ruin

Keen actions by Vietnam against a $1 million crypto scam have rescued hundreds, but what new measures are being implemented to safeguard citizens?

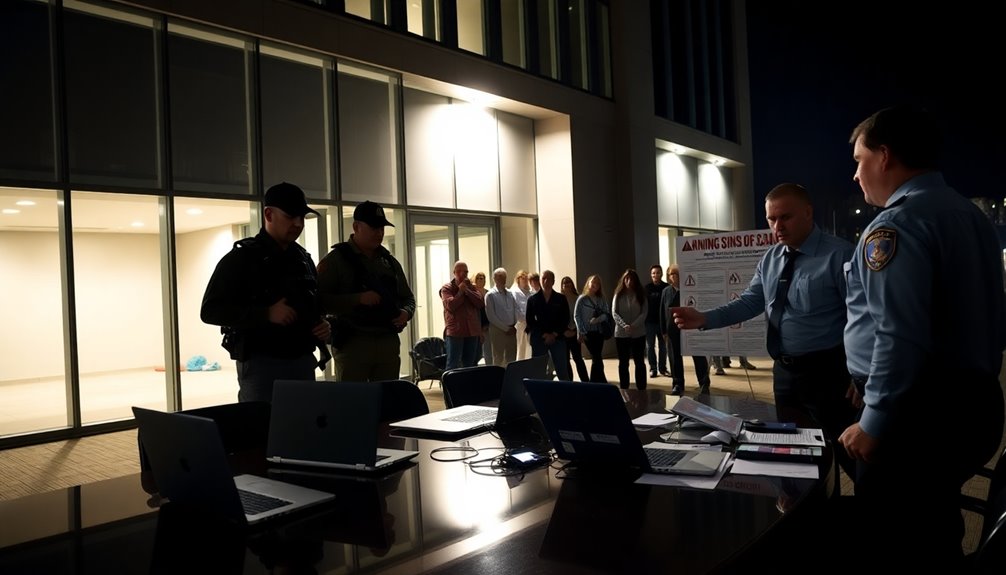

Vietnam's rapid actions against a $1 million crypto scam have saved hundreds from potential financial ruin. The scheme, which deceived around 500 victims through promises of high returns on a bogus cryptocurrency called QFS, targeted individuals and small businesses lacking financial knowledge. Authorities raided meeting spots and arrested key players to dismantle the operation. This crackdown highlights the ongoing effort to combat cryptocurrency fraud in the country. Public awareness campaigns aim to empower the community against such scams. Stay tuned to discover more about the measures being put in place to protect citizens and prevent future fraud.

Key Takeaways

- Vietnamese authorities identified a $1 million crypto scam involving 500 victims, primarily small business owners and individuals with limited financial literacy.

- The fraudulent scheme promoted a fake cryptocurrency token, QFS, through aggressive marketing and psychological manipulation.

- Police disrupted investor recruitment events, arrested key individuals, and seized documents to dismantle the operation.

- Community awareness initiatives, including workshops and seminars, aim to educate citizens on crypto safety and fraud detection.

- The government is enhancing regulatory measures and collaboration with financial institutions to prevent future crypto fraud.

Overview of the Million Smiles Scam

The Million Smiles scam deceived around 500 victims, including individuals and small businesses, by promoting a fraudulent cryptocurrency token known as QFS (Quantum Financial System). This scam resulted in financial losses totaling approximately $1.17 million (30 billion VND).

Most victims were small business owners and individuals from modest financial backgrounds, with individual investments ranging from 4 to 5 million VND ($190) and businesses investing up to 39 million VND ($1,350). One notable example includes a resident of Yen Bai who lost 39 million VND. Fortunately, nearly 300 potential victims were saved from falling into the trap.

The authorities' swift action highlighted the urgency of the situation, leading to a police raid on Million Smiles headquarters on December 24, 2024. During the raid, key individuals were detained, and crucial evidence, including financial records and promotional materials, was seized. Eight key individuals were apprehended during this operation, showcasing the scale of the fraudulent activities.

This scam not only impacted the victims directly but also raised alarms about the broader issue of cryptocurrency fraud in Vietnam, prompting public advisories to verify investment opportunities and report any suspicious activity.

Methods Used to Deceive Investors

Through a combination of aggressive marketing tactics and psychological manipulation, scammers behind the Million Smiles operation effectively lured investors into their web of deceit. They made false promises of financial freedom and exaggerated returns, claiming that investors could access a revolutionary financial ecosystem. Recognizing the signs of such scams is crucial for maintaining emotional health and protecting oneself from financial ruin. Additionally, the urgency created by the scammers often mirrors tactics seen in phishing scams, which exploit user trust and urgency.

By tying their scheme to spiritual beliefs about ancestral treasures and historic assets, they created an enticing narrative that many found hard to resist. The scammers fabricated legitimacy by establishing offices in luxurious villas and prominent business districts, making it appear as though their operations were credible. They hosted lavish promotional events and online webinars, where they painted visions of wealth and success, using national heritage claims to add credibility.

Financially, they redirected funds from new investors to maintain the illusion of success, spending collected money on extravagant branding rather than tangible crypto assets. Their tactics targeted small business owners and individuals from modest backgrounds, promising unrealistic returns that preyed on financial illiteracy. By fostering urgency and false scarcity, they manipulated emotions, convincing you that this was a once-in-a-lifetime investment opportunity. This reflects a common mechanism of scams where new investors are used to pay returns to earlier investors, creating a façade of profitability.

Police Actions and Investigations

Hanoi's police took decisive action against the Million Smiles scam, thwarting a large meeting intended to recruit 300 unsuspecting investors. They raided the company's headquarters, seizing crucial documents, computers, and other materials, effectively disrupting the scam before it could inflict further financial losses.

This operation prevented the scammers from collecting additional investments ranging from 4-5 million dong from individuals and up to 39 million dong from businesses. Investigations revealed that the QFS token was a fraudulent creation, not legally recognized in Vietnam. The evidence gathered showcased a scheme designed to exploit trust, luring individuals into financial contributions through deceptive advertising and exaggerated claims.

The police uncovered plans to promote the fake token, which misled investors with mythical ancestral treasures and spiritual guarantees. As a result of the operation, several individuals associated with the Million Smiles Company were arrested, dismantling the scam network and halting further fraudulent activities. This intervention is part of Vietnam's broader effort to combat cryptocurrency fraud by protecting potential victims, emphasizing a no-tolerance policy towards deceptive practices in the digital currency market and ensuring the protection of investors.

Impact on Victims and Community

Victims of the Million Smiles scam have faced devastating financial and emotional repercussions. The scam drained approximately $1.17 million from about 400 individuals and 100 businesses, with losses ranging from 4-5 million VND ($190) for individuals to 39 million VND ($1,350) for businesses.

Many of you were drawn in by promises of easy wealth and financial freedom, only to find yourselves facing financial devastation and emotional distress. The authorities intercepted the scheme before further damage occurred, highlighting the urgent need for vigilance.

The impact extends beyond just money; trust in legitimate investment opportunities has eroded. Those of you who invested often feel isolated, grappling with the weight of your losses. This sense of betrayal can lead to long-term psychological effects, making it difficult to engage with future financial opportunities.

Moreover, the scam highlights vulnerabilities within the community. Financial illiteracy and a lack of awareness about cryptocurrency risks allowed these perpetrators to thrive.

Many victims, including small business owners and those from rural areas, were lured by exaggerated promises. The long-term socioeconomic consequences could affect financial stability for years to come.

It's crucial for communities to learn from this experience and foster greater awareness to prevent similar scams in the future.

Measures to Enhance Public Awareness

As the threat of cryptocurrency scams looms larger, it's crucial for individuals and communities in Vietnam to become more informed about potential risks and protective measures. One significant initiative is Bitget's social campaign, aimed at educating you on secure crypto usage and fraud prevention. This campaign emphasizes the importance of understanding free crypto opportunities to avoid falling victim to scams.

You'll notice engaging posters and banners in public spaces, helping you detect and avoid scams like social engineering, romance scams, phishing, and investment fraud.

Law enforcement is doubling down too. Recent police actions in Hanoi dismantled a $1.17 million scam involving a fake token, preventing further victimization. They are also focusing on stricter oversight of crypto exchanges to combat financial crimes. Additionally, the rise in crypto investment frauds by 53% in 2023 has prompted authorities to take decisive action.

Moreover, community-wide efforts are underway. Seminars organized by local police and the Vietnam Blockchain Association encourage you to be vigilant. You'll find recommendations for workshops and online training tailored to diverse groups.

International cooperation is enhancing these initiatives. By collaborating with global organizations, authorities are improving their ability to trace illegal transactions.

With these combined efforts, you're empowered to slow down, verify information, and report suspicious activities, creating a more informed community ready to combat the rising tide of crypto scams.

Frequently Asked Questions

How Can I Recognize Potential Cryptocurrency Scams?

To recognize potential cryptocurrency scams, you should watch for unsolicited contact, especially from unknown individuals urging you to invest quickly.

Be cautious of promises of guaranteed returns or high gains that seem too good to be true.

Look for poor documentation, especially whitepapers lacking detailed information.

Avoid sharing sensitive information like passwords or private keys.

Lastly, if you see excessive marketing or urgency, it's best to proceed with extreme caution.

What Steps Should I Take if I Fall Victim to a Scam?

If you fall victim to a scam, act quickly. Report the incident to local law enforcement and your bank to freeze accounts.

Notify national fraud reporting centers, and forward any phishing emails to your email provider. Change your passwords and enable two-factor authentication on all accounts.

Monitor your finances closely, and consider contacting legal help if necessary.

Lastly, educate yourself on scams to prevent future incidents. Stay vigilant!

Are There Legal Protections for Cryptocurrency Investors in Vietnam?

You won't find strong legal protections for cryptocurrency investors in Vietnam.

Cryptocurrencies aren't recognized as legal currency or assets, creating uncertainty about ownership rights. Since there's a lack of clear regulations, disputes can be complicated.

While trading isn't banned, the absence of guidelines puts you at risk. The Vietnamese government is working on a regulatory framework, but until it's in place, navigating this gray area can be challenging.

How Can I Safely Invest in Legitimate Cryptocurrencies?

To safely invest in legitimate cryptocurrencies, start by researching projects and focusing on those with strong fundamentals.

Use reputable exchanges and enable two-factor authentication for added security.

Consider storing your crypto in hardware wallets to protect against hacks.

Avoid investing more than you can afford to lose, and don't fall for promises of unusually high returns.

Stay informed about market trends and regulatory changes to make educated decisions about your investments.

What Are the Signs of a Ponzi Scheme in Investments?

When you're looking at investments, watch for signs of a Ponzi scheme. If you hear promises of high returns with little risk or consistent returns that seem too good to be true, be cautious.

Check for unregistered investments and unlicensed sellers. If you feel pressured to invest quickly or notice payment difficulties, it's a red flag.

Always seek transparent information and avoid investments that lack clear documentation or detailed strategies.

Conclusion

In conclusion, the crackdown on the Million Smiles scam highlights the importance of vigilance in the crypto space. You must stay informed and cautious to protect yourself from potential fraud. By learning about the tactics scammers use and paying attention to warning signs, you can help safeguard your finances and those of your community. Together, we can create a more aware and resilient environment, ensuring that scams like this don't ruin lives or livelihoods.

Thorsten has been immersed in the cryptocurrency world for several years. His early experiences as a miner and active market participant have given him first-hand knowledge of the industry’s highs and lows. Thorsten’s approach is grounded in transparency and honesty, ensuring our editorial direction remains authentic, accurate, and reader-focused.

Crypto News

Crypto Investment Set To Reach $18B, 2025 Outlook Remains Strong

Major shifts in regulation and institutional interest are propelling crypto investment towards $18 billion, but what challenges could threaten this promising future?

Crypto investment is set to hit $18 billion, reflecting strong interest and favorable changes in the regulatory environment. More institutions are allocating a portion of their portfolios to digital assets, while optimistic price predictions for Bitcoin and Ethereum bolster confidence. The stablecoin market's growth also contributes significantly, with Tether leading the charge. Enhancements in technology, such as smart contracts and DeFi, are making cryptocurrencies more accessible. However, challenges like security concerns remain. As you explore further, you'll discover how these factors intertwine to shape a promising future for crypto investment.

Key Takeaways

- Institutional investments in cryptocurrencies are increasing, with 60% allocating over 1% of their portfolios to digital assets.

- Market capitalization for cryptocurrencies, excluding Bitcoin, is projected to reach $3.4 trillion by 2025.

- Bitcoin's price is expected to range between $75,500 and $150,000 by 2025, indicating strong growth potential.

- The stablecoin market capitalization is around $165.93 billion, with Tether dominating this space, facilitating significant transaction volume.

- Overall crypto investment is set to reach $18 billion, reflecting growing interest and acceptance in the market.

Regulatory Landscape Transformation

The regulatory landscape for cryptocurrencies is on the brink of transformation, with significant changes expected under the new administration. As Trump takes office, you can expect a more favorable environment for crypto, especially with Paul Atkins stepping in as SEC chairman. His advocacy for cryptocurrencies signals a shift toward streamlined regulations that could bolster innovation and growth.

Legislation like the Financial Innovation and Technology for the 21st Century Act (FIT21) aims to clarify the roles of the CFTC and SEC in regulating digital assets. This clarity could help you navigate compliance more easily. Furthermore, the expected approval of spot ETFs in January 2024 may further legitimize bitcoin as a key investment asset.

The CFTC's anticipated enforcement actions against digital asset firms will be crucial to maintaining a fair market, especially with the rising interest from retail investors.

Moreover, improvements in wallet verification processes expected in 2025 may ease compliance with Know Your Customer and Anti-Money Laundering laws.

As the regulatory framework solidifies, you could see increased scalability for tokenized assets and more opportunities for institutional investment. The promise of a clear regulatory environment positions the U.S. as a potential "bitcoin hub," making it an exciting time for crypto enthusiasts and investors alike.

Surge in Institutional Investment

As institutional interest in cryptocurrencies continues to grow, many organizations are now allocating significant portions of their portfolios to digital assets. In fact, 60% of institutions allocate more than 1% of their portfolios to these assets, with 35% investing between 1%-5%.

Notably, institutions managing over $500 billion in assets under management (AUM) show a strong commitment, with 45% allocating more than 1% to digital assets. Hedge funds are particularly eager to dive into this space, often moving faster than their larger counterparts. Smaller institutions frequently allocate even greater portions of their portfolios to digital assets, reflecting their bullish outlook.

Interestingly, there's a shift toward registered vehicles for crypto investment. About 62% of institutions prefer exposure through these regulated products rather than owning spot crypto directly. Moreover, many institutions are anticipating increased allocations to digital assets in future years.

The launch of Bitcoin ETPs in January 2024 has significantly boosted this trend, offering a familiar and regulated avenue for BTC exposure. With BlackRock and others entering the market, traditional finance and crypto are increasingly converging, suggesting a robust future for institutional investment in digital assets.

Optimistic Price Predictions

Growing institutional interest in cryptocurrencies sets the stage for optimistic price predictions across the market. Bitcoin's price is projected to range from $75,500 to $150,000 in 2025, with some analysts stretching targets up to $180,000. Historical performance post-halving supports this potential, especially with firms like Blackrock gearing up for increased BTC trading instruments, signaling strong bullish sentiment. Furthermore, the strong bullish trend driven by institutional adoption may enhance Bitcoin's price trajectory.

Ethereum's outlook is just as promising, with prices expected between $3,105 and $5,701, and a stretched target of $5,888. Key levels, such as $4,600, are crucial indicators of upward trends, fueled by advancements in Ethereum 2.0 and DeFi adoption.

For altcoins, projections vary widely but remain optimistic. Solana could see prices range from $184 to $555, while XRP might hit between $1.44 and $4.44. Dogecoin's targets range from $0.31 to $1.44, with a stretched target of $2.20.

As technological innovations and regulatory advancements unfold, the total market cap, excluding Bitcoin, could reach $3.4 trillion by 2025, further solidifying the case for bullish price predictions across the crypto landscape.

Growth of the Stablecoin Market

Accelerating in popularity, the stablecoin market has seen significant growth over the past few years. As of July 2024, the total market capitalization reached approximately $165.93 billion, showcasing a robust monthly growth rate of 3%. Additionally, the stablecoin market experienced a monthly growth rate of 3% in 2024, reflecting its increasing adoption and usage.

Tether (USDT) dominates this space with a market cap of $114.08 billion, preferred by 86.2% of users in a recent poll.

You'll notice that over 27.5 million active users engage with stablecoins, with around 30% of global remittances facilitated through them. Businesses are catching on too, with over 25% now accepting stablecoins as a payment method.

The transaction volume has surged, increasing by 50% year-over-year, and stablecoins comprise more than 80% of daily cryptocurrency trades.

Regulatory compliance is improving, with 80% of stablecoins adhering to some form of regulations. Institutional interest is also rising, as they hold 30% of the total stablecoin supply.

With average yields on stablecoin savings accounts reaching 6%, traditional investors are taking notice. Overall, the stablecoin market's growth shows no signs of slowing, positioning itself as a key player in the evolving crypto landscape.

Technological Innovations on the Rise

Technological innovations are revolutionizing the cryptocurrency landscape, driving efficiency and enhancing user experience. Smart contracts, for instance, automate processes by embedding terms directly into code, minimizing errors and fraud. This automation extends to programmable assets, which open up exciting new applications across various sectors, including finance and real estate. With the Binance BNB Chain's EVM compatibility, developers can easily migrate their code from Ethereum, boosting flexibility and creativity. Scalability solutions like Layer-2 protocols and sharding significantly enhance transaction efficiency, addressing growing demand. As you explore cross-chain solutions, you'll find that they facilitate seamless data exchange between blockchains, creating a more interconnected ecosystem. Moreover, privacy enhancements, such as zero-knowledge proofs and homomorphic encryption, protect sensitive information while ensuring compliance with privacy laws. The rise of decentralized finance (DeFi) platforms is also driving innovation by enabling peer-to-peer financial services without intermediaries.

Challenges Facing Crypto Adoption

Numerous challenges hinder the widespread adoption of cryptocurrencies, creating significant barriers for users and businesses alike. One major issue is regulatory uncertainty. Without clear guidelines, you may feel confused about how to engage with cryptocurrencies safely. Central banks are cautious about integrating these digital assets into mainstream payment systems, which only adds to the ambiguity. In fact, a survey from December 2022 indicates that central banks are skeptical about day-to-day transactions involving cryptocurrencies.

Security and trust issues further complicate matters. Many potential users are skeptical, with 39% feeling not at all confident in the reliability of cryptocurrencies. Hacking, phishing, and vulnerabilities in smart contracts raise valid concerns about safety. Stronger education on security practices is essential to build confidence.

Scalability and volatility also present hurdles. Popular cryptocurrencies like Bitcoin and Ethereum often struggle with slow transaction times and high costs, deterring everyday use. Their price fluctuations make them unreliable as a store of value, which can be a dealbreaker for businesses considering accepting them.

Finally, significant gaps in adoption and education persist. While 81% of people are familiar with digital currencies, only 33% are willing to use them for payments. Investing in educational initiatives is crucial to bridge this divide and foster greater understanding of cryptocurrencies.

Future Opportunities for Growth

The future of cryptocurrency holds exciting opportunities for growth, especially as the regulatory landscape begins to shift. With pro-crypto appointments like Paul Atkins at the SEC, you're likely to see a more accommodating environment for crypto operators. Regulatory clarity could lead to a more stable environment for crypto investments, which in turn could attract more investors to the market.

Regulatory clarity won't only boost confidence but could also impact global crypto markets, opening doors for new investments.

Institutional and mainstream adoption is gaining momentum, too. Bitcoin ETF approvals are making it easier for you to invest in Bitcoin, while major firms like Blackrock prepare for more trading instruments.

As brands like Nike and Starbucks embrace blockchain technology, you can expect even broader acceptance.

Technological advancements will further enhance growth potential. The tokenization of assets is projected to soar from $2 billion to $2 trillion by 2030, while AI integration is set to improve user interactions.

Ethereum's advancements and Solana's scalability promise a robust future for decentralized finance.

Lastly, market dynamics indicate that Bitcoin and Ethereum could see significant price increases by 2025, with stablecoins projected to double in market cap.

All these factors create a fertile ground for your crypto investments.

Frequently Asked Questions

How Do I Start Investing in Cryptocurrencies?

To start investing in cryptocurrencies, you'll first need to research different coins and choose ones that align with your goals.

Create an account on a reputable exchange and make sure to secure your account with strong passwords.

Once you've bought some crypto, store it in a secure wallet.

Keep an eye on market trends and stay informed about risks like volatility and regulatory changes.

What Are the Risks of Investing in Bitcoin?

When investing in Bitcoin, you face several risks.

There's high volatility, meaning prices can swing dramatically, affecting your investment's value.

Regulatory uncertainty adds another layer; sudden crackdowns could impact your ability to trade.

Security risks are significant, too, since transactions are irreversible and exchanges can be hacked.

Additionally, you should be cautious of management practices and market influence from larger investors, which can create further instability in your investment.

Which Crypto Exchanges Are the Most Reliable?

When choosing reliable crypto exchanges, consider Coinbase and Kraken. They've strong security measures, including cold storage and two-factor authentication.

Coinbase offers a user-friendly interface with FDIC insurance on fiat assets, while Kraken is known for excellent customer support and educational resources.

Both platforms have no major hacks in their history, ensuring your investments remain secure.

Always research and ensure the exchange complies with regulations for added peace of mind.

How Can I Safely Store My Cryptocurrencies?

To safely store your cryptocurrencies, consider using hardware wallets, as they keep your private keys offline and secure.

Always choose reputable providers and enable two-factor authentication for added protection.

Regularly back up your wallet, especially your recovery phrase, and store backups in a safe place.

Combining hot and cold wallets can help manage daily transactions while protecting your long-term investments.

Stay informed about your wallet's security features and recent vulnerabilities.

What Factors Influence Cryptocurrency Market Volatility?

Cryptocurrency market volatility is influenced by various factors.

You've got market sentiment, where news and social media can sway prices dramatically. Emotional trading based on fear or greed heightens this effect.

Additionally, trading volume and liquidity play crucial roles; significant trades can cause price swings.

Regulatory changes and macro-economic conditions also impact the market.

Lastly, technological advancements and security issues can lead to sudden price drops or increases, adding to the overall unpredictability.

Conclusion

As we look ahead, it's clear that the crypto investment landscape is evolving rapidly. With regulatory changes, increasing institutional interest, and technological advancements, you've got plenty of reasons to stay optimistic. While challenges remain, the growth of stablecoins and innovative solutions opens up exciting opportunities for you to explore. Keep an eye on these trends, as they'll likely shape a robust future for crypto investment, potentially reaching that $18 billion milestone by 2025.

Thorsten has been immersed in the cryptocurrency world for several years. His early experiences as a miner and active market participant have given him first-hand knowledge of the industry’s highs and lows. Thorsten’s approach is grounded in transparency and honesty, ensuring our editorial direction remains authentic, accurate, and reader-focused.

-

Crypto News2 weeks ago

Crypto News2 weeks agoCrypto Public Offers Face Scrutiny as UK FCA Proposes Ban—All the Details

-

BitCoin2 weeks ago

BitCoin2 weeks agoMicroStrategy Adds Another $1.5 Billion in Bitcoin to Its Holdings

-

Memecoins and Altcoins2 weeks ago

Memecoins and Altcoins2 weeks agoOverlooking DTX Exchange at $0.12 Is Comparable to Ignoring DOGE Before Its 7,500% Surge

-

Industry Insights and Breakthroughs2 weeks ago

Industry Insights and Breakthroughs2 weeks agoUse AI as Your Shortcut to the Sweet Spot of Earnings

-

Industry Insights and Breakthroughs2 weeks ago

Industry Insights and Breakthroughs2 weeks agoOnly 104 Ethereum Whales Hold a Jaw-Dropping 57% of All ETH Supply – You Won’t Believe Who They Are

-

Memecoins and Altcoins2 weeks ago

Memecoins and Altcoins2 weeks agoEXPOSED: Wallitiq Vs Dogecoin – Insiders Reveal Which Token Will 100X First

-

BitCoin2 weeks ago

BitCoin2 weeks agoXRP to Hit $5 by January? Crypto Analyst Reveals When It Will Break $10

-

Industry Insights and Breakthroughs2 weeks ago

Industry Insights and Breakthroughs2 weeks agoSelena Gomez’s Unexpected Fortune—Pop Princess Turned Powerhouse Investor