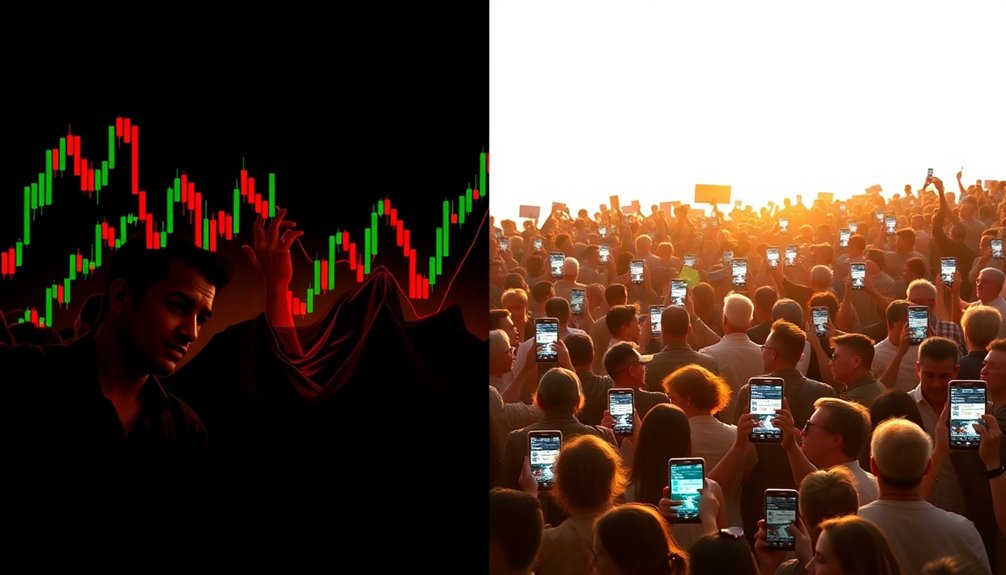

You're witnessing Bitcoin's wild price swings, and while many retail investors are panicking, some are quietly accumulating. This contrast raises important questions about market sentiment and future trends. Are we on the brink of a significant recovery despite the chaos? As institutional players take notice and fundamentals strengthen, the potential for a breakout is real. What might this mean for your investment strategy moving forward?

As Bitcoin's annual volatility reaches historic lows, you might wonder how this stability impacts retail sentiment. With monthly realized volatility now at 11%, down from previous peaks of 16% and 14%, it's clear that Bitcoin is entering a more mature phase. This shift toward stability could be reshaping how retail investors view the market, especially as large players, or institutional investors, start to dominate the landscape. You may find that these changes create a sense of cautious optimism among retail traders.

Interestingly, even as Bitcoin's price sees fluctuations, retail interest in the cryptocurrency has surged. The sentiment remains high, allowing you to feel a sense of confidence, particularly during consolidation phases. Many smaller investors are now taking the opportunity to accumulate Bitcoin, viewing it as a safe haven against broader market volatility. This perspective is becoming increasingly common, especially as discussions about pro-crypto policies gain traction. Strong retail interest could lead to renewed buying pressure and a potential rebound. Moreover, as retail sentiment improves, it may attract referral programs that incentivize new investors.

You might notice a stark contrast between the actions of retail investors and those of whales—large institutional investors accumulating Bitcoin even during downturns. While many retail traders panic-sell in response to price drops, whales seem to be taking advantage of these moments to grow their holdings. This divergence can signal potential market bottom formations, which might suggest a recovery is on the horizon.

Observing on-chain data, you can see that while whales are confident and accumulating, retail investors are often exiting the market, which creates an interesting dynamic.

Given the current market conditions, you could expect a potential breakout in Bitcoin's price. The combination of lower volatility and strong fundamentals hints that a significant price move may be just around the corner. Historical trends show that reduced volatility often precedes substantial price increases, and with rising institutional demand, analysts predict potential price targets of $110K or higher if Bitcoin surpasses current resistance levels.

With favorable macroeconomic conditions, like a potential reversal in the U.S. Dollar Index, supporting Bitcoin's growth, your outlook as a retail investor might just be brightening. The market is shifting, and as you navigate this landscape, it's essential to stay informed. Embracing this newfound stability could lead to exciting opportunities for those willing to hold onto their Bitcoin amidst the noise.