Alex Mashinsky's guilty plea has sent shockwaves through the crypto world, revealing severe flaws in Celsius Network's operations. Once a promising platform, Celsius attracted many investors by offering high-interest rates. However, Mashinsky misled them about the company's liquidity and solvency, leading to immense losses. This has sparked anger and betrayal among the crypto community and raised concerns about the need for stricter regulations. Investors are now questioning their trust in crypto projects. As the industry faces potential legal changes, you'll discover more about how this collapse might reshape the future of decentralized finance.

Key Takeaways

- Alex Mashinsky's guilty plea for fraud has raised serious concerns about transparency and accountability in the cryptocurrency sector.

- The collapse of Celsius Network has led to widespread distrust among investors, prompting calls for stricter regulations in the crypto industry.

- Community reactions reflect feelings of betrayal, highlighting the need for enhanced financial disclosures and ethical practices within crypto platforms.

- Increased regulatory scrutiny is anticipated, with potential changes to compliance standards and reporting requirements for cryptocurrency firms.

- Lessons from the Celsius collapse emphasize the importance of transparency and community engagement to foster trust and mitigate risks in the crypto market.

Background on Celsius Network

Celsius Network emerged as a prominent player in the cryptocurrency space, offering users a platform to earn interest on their digital assets. Founded in 2017, it quickly gained traction among crypto enthusiasts, positioning itself as a key player in the decentralized finance (DeFi) ecosystem.

You could deposit a variety of cryptocurrencies and earn competitive interest rates, often considerably higher than traditional banks. With its user-friendly interface and attractive rewards, Celsius appealed to both seasoned investors and newcomers alike.

The platform operated on a simple premise: by lending out your assets to institutional borrowers, Celsius could provide you with attractive returns. Users appreciated the transparency around interest rates and the ease of accessing their funds. Additionally, the company's native token, CEL, allowed users to boost their earnings further.

As Celsius expanded, it also developed a community-oriented approach, encouraging users to engage with the platform through various initiatives.

However, this rapid growth would later become a double-edged sword, as the pressures of managing assets and the complex regulatory environment began to mount. Ultimately, the journey of Celsius Network would take unexpected turns that sent shockwaves through the crypto community.

Alex Mashinsky's Rise in Crypto

You might be surprised to learn how Alex Mashinsky's early innovations in crypto set the stage for his later success.

As a leader at Celsius Network, he pushed the boundaries of what was possible in the industry.

This rise not only showcased his vision but also attracted considerable attention and investment.

Early Innovations in Crypto

During the early days of cryptocurrency, few innovators made as significant an impact as Alex Mashinsky. You might remember him as a pivotal figure who pushed the boundaries of what was possible in the crypto space.

His vision and creativity were instrumental in shaping the industry, and he introduced several groundbreaking concepts that still resonate today.

Here are some of his key early innovations:

- Voice over Internet Protocol (VoIP): Mashinsky's expertise in VoIP laid the groundwork for decentralized communication in crypto.

- Celsius Network: He founded this platform to allow users to earn interest on their crypto holdings, popularizing the concept of crypto lending.

- Decentralized Finance (DeFi): By advocating for financial services without intermediaries, he helped spark interest in DeFi solutions.

- Tokenization: Mashinsky championed the idea of converting real-world assets into digital tokens, increasing accessibility and liquidity.

- Community Engagement: He emphasized the importance of building a strong community around crypto projects, fostering collaboration and innovation.

Through these innovations, you've seen Mashinsky's influence ripple throughout the crypto landscape, paving the way for future advancements.

Leadership at Celsius Network

Alex Mashinsky's leadership at Celsius Network marked a significant turning point in his career and the broader crypto industry. You witnessed how he positioned Celsius as a major player in the crypto lending space, attracting users with promises of high-interest yields on deposits. His vision focused on making financial services more accessible, which resonated with many who were frustrated with traditional banking systems.

Under his guidance, Celsius grew rapidly, amassing billions in assets. You could see the excitement among investors and users alike as the platform offered innovative solutions, such as earning interest on crypto holdings and low-cost loans. Mashinsky's charismatic personality and his ability to articulate a compelling narrative about decentralization drew significant attention.

However, as the crypto market faced volatility, you also noticed the cracks in Celsius' operations. Leadership decisions began to raise eyebrows, and the once-promised returns became increasingly difficult to sustain.

As Mashinsky's legal troubles emerged, the very foundation he built started to crumble, leaving investors questioning the integrity of his leadership. Ultimately, his rise and fall exemplify the volatile nature of the crypto world, serving as a cautionary tale for future leaders.

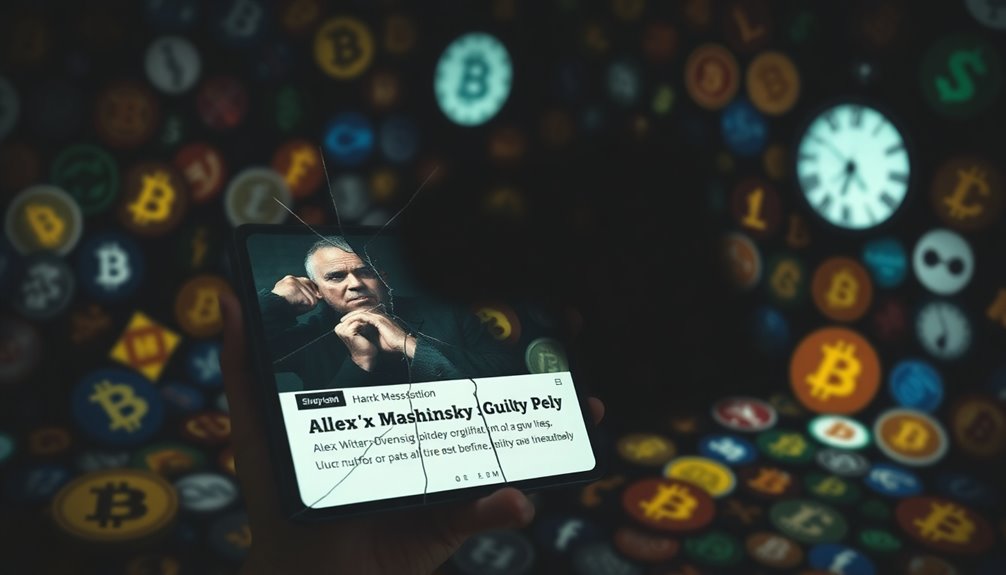

Details of the Guilty Plea

In a shocking turn of events, Mashinsky admitted to multiple charges related to fraud and conspiracy, acknowledging his role in misleading investors about the financial health of Celsius Network. This admission has sent ripples through the crypto community, raising questions about the integrity of financial disclosures in the industry.

Mashinsky's plea specifically highlighted several key points:

- He misrepresented Celsius's liquidity and solvency to attract more investors.

- Promises of high returns were made without disclosing underlying risks.

- Internal communications revealed knowledge of potential financial instability.

- He pressured employees to maintain a positive public image, despite growing concerns.

- The admissions could lead to further investigations into Celsius's operations and financial practices.

As you digest this news, it's important to recognize the implications of Mashinsky's actions. His guilty plea not only tarnishes his reputation but also casts a shadow over the practices of similar firms in the crypto landscape.

The details of his plea paint a troubling picture of deception and mismanagement, leaving many to wonder how this could have happened in such a prominent organization.

Impact on Investors

The fallout from Mashinsky's guilty plea is hitting investors hard, leaving many grappling with the reality of their losses. You might find yourself in a precarious position if you'd trusted Celsius with your funds, believing in the platform's supposed stability and growth potential.

The abrupt collapse of the company and its associated financial turmoil can feel like a betrayal, especially if you invested significant amounts of your hard-earned money.

Many of you're now facing uncertainty about the recovery of your assets. With the bankruptcy proceedings underway, it's unclear how much, if anything, you'll see returned.

This situation hasn't only affected your finances but also shaken your confidence in the broader crypto market. You may feel hesitant to invest again or question the legitimacy of other platforms.

As you navigate these uncertainties, consider seeking professional financial advice. It's vital to understand your options and potential next steps.

You're not alone in this struggle, and there may be resources available to help you through these challenging times. Remember, staying informed is key to making better decisions moving forward.

Reactions From the Crypto Community

Reactions from the crypto community have been swift and intense following the news of Mashinsky's guilty plea. Many in the space feel a mix of betrayal and anger, as this saga has further eroded public trust in cryptocurrency platforms.

You might find yourself wondering how individuals and organizations are responding to this seismic event.

Here's a snapshot of the reactions circulating within the community:

- Calls for Accountability: Many advocates are demanding stricter regulations to prevent similar incidents in the future.

- Community Divisions: Some supporters of Celsius express loyalty to Mashinsky, while others vehemently oppose his actions.

- Increased Skepticism: Investors are questioning the credibility of crypto projects, leading to a more cautious approach.

- Debates on Transparency: Discussions about the need for greater transparency in crypto operations are heating up.

- Heightened Vigilance: Many users are now more vigilant about the platforms they choose, prioritizing security over potential gains.

As you observe these reactions unfold, it's clear the community is grappling with the implications of Mashinsky's actions and how they'll shape the future of cryptocurrency. As debates intensify, many are questioning how trust can be rebuilt in a space so often shaken by controversy. Recent developments, such as Putin’s Bitcoin bombshell, have only added more fuel to the conversation, leaving industry leaders and investors alike speculating on the geopolitical implications. The intersection of individual actions and global maneuvers underscores the fragility and potential of the cryptocurrency landscape.

Regulatory Implications

As you consider the fallout from Alex Mashinsky's guilty plea, think about how this case could lead to increased regulatory scrutiny for the entire crypto industry.

The legal precedents set by this situation may reshape compliance standards, making it essential for companies to adapt.

You'll want to stay informed on how these implications might affect your investments and the broader market landscape.

Increased Regulatory Scrutiny

In light of Alex Mashinsky's guilty plea, regulatory bodies are ramping up their scrutiny of the cryptocurrency sector.

You might notice a shift in how these agencies approach crypto companies, as they aim to restore trust and guarantee compliance. This increased oversight could lead to significant changes in how businesses operate within the space.

Here are some key areas of focus for regulators:

- Transparency Requirements: Companies may need to provide clearer information about their operations and financials.

- Enhanced Reporting Standards: Regulators could impose stricter reporting guidelines to monitor financial health and risks.

- Consumer Protection Measures: Expect more regulations aimed at safeguarding investors from fraudulent practices.

- Licensing and Registration: Businesses might be required to obtain licenses to operate legally, guaranteeing accountability.

- Penalties for Non-compliance: Stricter consequences could be enforced for those who fail to adhere to new regulations.

As you navigate this evolving landscape, staying informed about these changes will be essential for compliance and growth in the cryptocurrency market.

The implications of increased regulatory scrutiny are likely to shape the future of crypto in profound ways.

Potential Legal Precedents

The guilty plea from Alex Mashinsky could set significant legal precedents that shape the regulatory landscape for cryptocurrency companies. As regulators ramp up their scrutiny, your understanding of the implications becomes vital. This case could influence how authorities define fraud, liability, and consumer protection in the crypto space.

Here's a look at potential legal precedents that might emerge:

| Legal Aspect | Potential Precedent | Implication for Crypto Firms |

|---|---|---|

| Fraud Definition | Broader interpretation of fraud | Increased liability for misleading claims |

| Liability | Personal liability for executives | Greater accountability for actions taken |

| Consumer Protection | Enhanced regulations for transparency | Stricter disclosure requirements |

| Enforcement Actions | More frequent and aggressive actions | Heightened risk of legal repercussions |

As these legal precedents unfold, you'll need to stay informed. Understanding how these shifts affect compliance and business practices will be essential for maneuvering the evolving regulatory environment. Your proactive approach could help you mitigate risks and adapt to new rules that emerge from such landmark cases. Additionally, the outcome may prompt further examination of IRA investment strategies as firms seek to navigate compliance amidst changing regulations.

Impact on Compliance Standards

With the evolving legal landscape following Alex Mashinsky's guilty plea, compliance standards for cryptocurrency firms are likely to tighten considerably.

You can expect regulators to scrutinize operations more closely, leading to a shift in how companies manage risk and comply with existing laws. This heightened focus on compliance won't only affect current practices but also reshape industry expectations.

Here are some key implications you should consider:

- Increased Regulatory Oversight: Expect more frequent audits and reviews from regulatory bodies.

- Stricter Reporting Requirements: Companies may need to provide more detailed financial disclosures and operational data.

- Enhanced KYC/AML Procedures: Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols will likely be reinforced.

- Standardization of Practices: Companies might adopt standardized compliance frameworks to align with evolving regulations.

- Potential for Increased Penalties: Non-compliance could lead to stiffer fines and sanctions, making adherence even more critical.

As a result, it's crucial to stay informed and proactive about compliance to navigate the changing landscape effectively.

Lessons Learned From the Collapse

Reflecting on the collapse of Celsius, you can draw important lessons that highlight the risks inherent in the cryptocurrency space.

First, it's essential to understand that high returns often come with high risks. The allure of impressive yields can cloud judgment, leading you to invest without proper due diligence. You should be cautious about platforms that promise returns that seem too good to be true.

Second, transparency is important. Celsius's downfall was partly due to a lack of clear communication and understanding of its operations. You must prioritize platforms that are open about their business practices, financial health, and risk management strategies.

Third, diversification is key. Relying too heavily on a single platform can expose you to significant losses. Spread your investments across various assets and platforms to mitigate risk. Additionally, consider employing risk management strategies to further protect your investments in this volatile market.

Lastly, stay informed and updated about the regulatory landscape. As the crypto space evolves, so do the laws governing it. Being aware of your rights and the protections available can help you make more informed decisions.

Future of Decentralized Finance

As you consider the lessons learned from the Celsius collapse, it's clear that the future of decentralized finance (DeFi) holds both promise and challenges.

DeFi aims to create a more open and accessible financial system, but it's important to address the risks that accompany this innovation. As you navigate this evolving landscape, keep the following points in mind:

- Regulatory Oversight: Governments are likely to impose stricter regulations to protect investors and guarantee market stability.

- Security Protocols: Improved security measures will be essential to safeguard against hacks and fraud, which can undermine trust in DeFi platforms.

- User Education: Increased efforts to educate users about risks and best practices will be necessary for broader adoption.

- Interoperability: Seamless integration between different blockchain networks can enhance functionality and user experience.

- Sustainability: Focus on environmentally friendly practices will become crucial as concerns about the ecological impact of DeFi grow.

- AI-Driven Insights: Leveraging data-driven insights from AI can help identify market trends and inform better investment strategies in the DeFi space.

Rebuilding Trust in Crypto

Rebuilding trust in crypto is essential for its long-term viability, especially in the wake of recent collapses like Celsius. You can start by advocating for increased transparency within projects. When companies share clear information about their operations and financials, it promotes accountability and helps you feel more secure in your investments. Additionally, the implementation of strong encryption standards can protect user information and bolster confidence in crypto platforms.

Next, you should demand better regulation in the crypto space. By supporting frameworks that protect consumers while fostering innovation, you can help create an environment where bad actors are less likely to thrive. Look for projects that prioritize compliance and work with regulators.

Community engagement is also vital. Participating in discussions, attending meetups, or joining online forums can help you stay informed about industry developments. By connecting with others, you can share knowledge and build a network of trusted sources. Additionally, leveraging predictive analytics can enhance decision-making and reduce risks in your investment strategy.

Frequently Asked Questions

What Charges Did Alex Mashinsky Plead Guilty To?

You might be curious about the charges Alex Mashinsky pleaded guilty to.

He admitted to fraud and conspiracy, specifically related to misleading investors about the financial health of his company.

You'll find that these charges reflect serious legal issues, as they involve deceptive practices that misled individuals about the risks associated with their investments.

It's a significant moment that highlights the importance of transparency and honesty in the financial industry.

How Did Celsius Network Initially Attract Investors?

Imagine a dazzling oasis in the desert of finance, where Celsius Network lured you in with promises of sky-high returns on your crypto holdings.

They marketed their platform as a revolutionary way to earn interest, boasting rates that seemed almost too good to be true.

With flashy ads and testimonials from thrilled users, you couldn't resist the allure.

Their innovative approach made it feel like you were stepping into the future of investing!

What Was the Role of CELsius's Native Token, CEL?

Celsius's native token, CEL, played a vital role in attracting users to the platform. You could earn higher interest rates on your deposits by holding CEL, which incentivized many to buy and use the token.

Additionally, CEL offered benefits like lower loan interest rates and exclusive rewards, creating a sense of loyalty among investors. Its utility within the Celsius ecosystem made it a key component of the platform's appeal and functionality.

How Will This Affect Ongoing Crypto Regulations?

The fallout from this situation could shake the crypto world like an earthquake!

You'll likely see regulators stepping up efforts to impose stricter guidelines, aiming to prevent similar incidents from happening.

This increased scrutiny might lead to clearer rules around digital assets and lending practices.

As a result, you'll want to stay informed about any new regulations that could impact your investments and strategies in the evolving crypto landscape.

What Are the Potential Legal Consequences for Mashinsky?

If Mashinsky's guilty plea leads to a conviction, you might see significant legal consequences, including hefty fines and potential prison time.

His actions could trigger civil suits from investors and regulatory penalties from agencies seeking to uphold compliance standards.

Additionally, you'll want to keep an eye on how this shapes future legal precedents in the crypto space, as it could influence the way authorities approach similar cases moving forward.

Conclusion

In light of Alex Mashinsky's guilty plea, the crypto landscape faces a seismic shift that can't be ignored. Investors are left grappling with uncertainty, but this moment also offers a chance to rebuild trust and learn valuable lessons. As the dust settles, it's essential to push for stronger regulations and transparency in decentralized finance. The road ahead may be rocky, but with resilience, the crypto community can emerge stronger than ever, forging a more secure future.